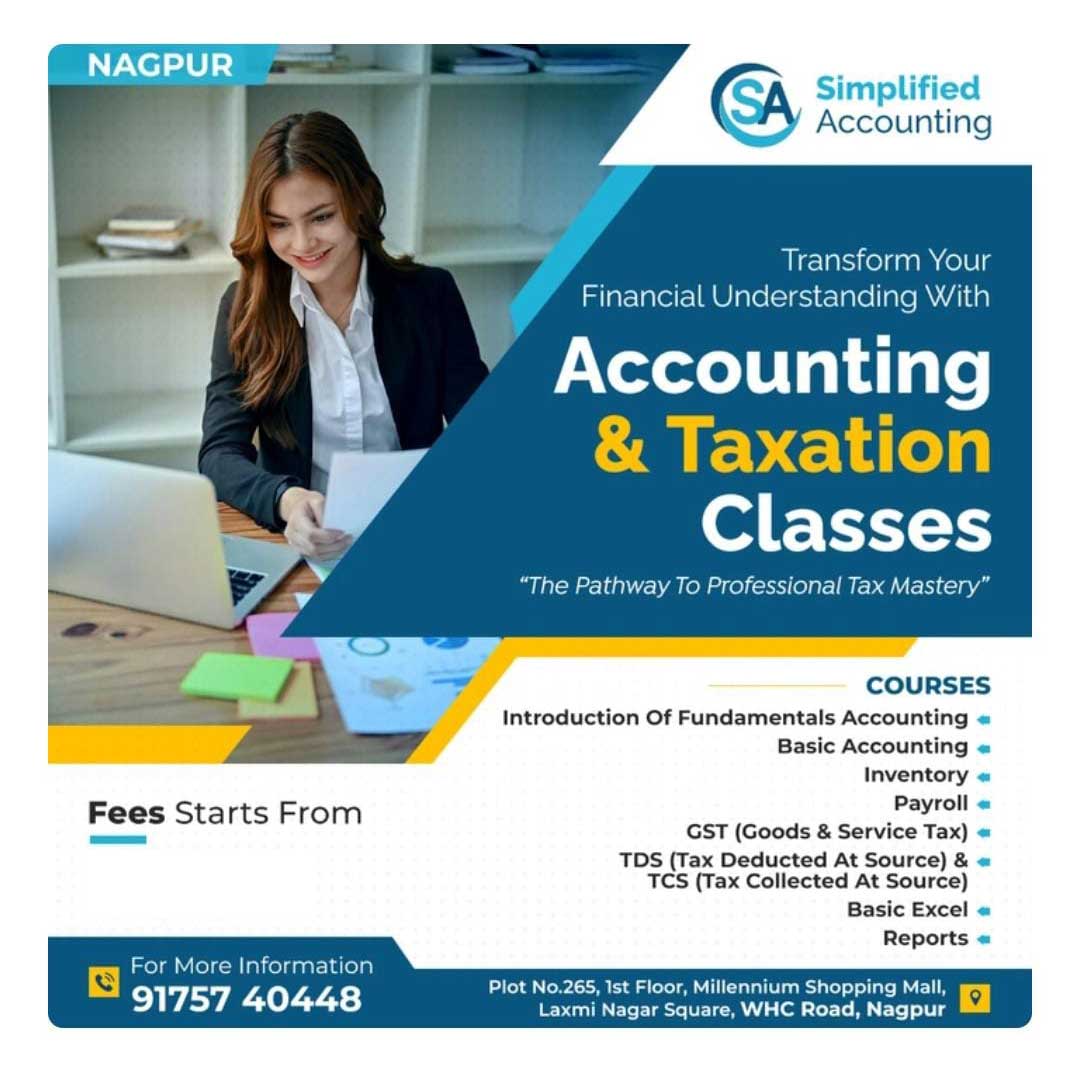

Our Course Modules

INTRODUCTION OF FUNDAMENTALS ACCOUNTING

- The Need for Accounting

- Accounting Principles

- Different Types of Accounting

- Understanding Accounting Rules

- Single Entry and Double Entry Methods of Accounting

- Advantages of Double Entry

- Journalizing Transactions

- Bookkeeping

- Disadvantages of Managing Accounts Manually

BASIC ACCOUNTING

- Company Creation

- Ledgers &Groups

- Vouchers Entry

- Cost Centers

- Trial Balance

- Profit & Loss A\c

- Balance Sheet

INVENTORY

- Stock Item Creation

- Stock Group Creation

- Stock Category Creation

- Godown Creation

- Inventory Management

PAYROLL

- Configuration of Payroll

- Employee Category

- Employee Group

- Pay Head

- Attendance & Production Types

- Salary Processing & Payroll Report

GST (Goods & Service Tax)

- Basic Introduction of GST (Goods & Service Tax)

- Configuration of GST in Tally

- Preparation of GSTR3B & GSTR-1 & GSTR2A in Tally Prime

- Online GSTR3B & GSTR-1 & GSTR2A Return Filling

- Preparation of E-Way Bill with Complete basic to advance knowledge

- Configuration of E-Invoicing in Tally Prime with Complete basic to advance knowledge

- E-invoicing with Tally Prime

- ITC (Input Credit Tax)

TDS (Tax Deducted At Source) & TCS (Tax Collected At Source)

- Basic Introduction of TDS (Tax Deduct at source)

- Basic Introduction of TCS (Tax Collect at source)

- Configuration of TDS & TCS in Tally Prime

- Sections of TDS & TCS

- TDS & TCS of payment creation

- TCS nature of goods

- TDS and TCS Return Filling

Basic Excel

- Pivot table

- V-Lookup

- Formulas

- Tables & Formatting

REPORTS

- Accounting Reports

- Day Book

- Cash Flow / Fund Flow Report

- Statement of Accounting

- Inventory Reports

- Statement of Inventory

- Stock Summary Reports

- Statutory Report

- GST Report

- TDS Report

- Payroll Reports

- Exception Reports

- Analysis & Verification

- Printing Report